September 2022 Market Update

There’s no question that rising interest rates are weighing down home sales. Year-to-date, the shift in affordability has had a greater impact on the single-family home market, with sales down 34.4% from a year ago. Condo market sales are down 19.3%.

With new listing inventory still low, the median sales price has remained relatively flat over the last several months. The single-family home median price was $1,100,000 last month while the condo median price was $502,500.

Properties are spending more time on the market. The median days on market for single-family homes rose to 18 days, compared to 9 days in September 2021, and condos marked 14 days in September, compared to 11 days during the same period last year. Although active inventory has increased due to spending more time on the market, up 44% and 11% for single family homes and condos, respectively, it is still approximately 40% below its 2019 pre-pandemic level.

What does this mean for home sellers?

Home inventory remains low, but buyers don’t have the same sense of urgency as they did earlier in the year. It is important to showcase your home in its best light and price it right from the start. Buyers and their agents will decide to visit your home, or not, by looking at your property photos online. Are they professionally done or are the photos taken with a smart phone in bad lighting? You only have one chance to make a great first impression when your property hits the market. Strategizing with your agent up front based on your goals, and adjusting accordingly based on market feedback and conditions will be key.

What does this mean for buyers?

The shifting market means that you have more time to preview homes and decide if you want to put in an offer. There are less buyers in the market now, which translates to less competition, and more opportunity in negotiating a successful offer.

Regardless of interest rates being at historical lows or now, at highs, the decision to buy should be based on your needs and budget. Focus on your monthly mortgage payment instead of interest rates. There will be the option to refinance later when interest rates drop or when you build equity in your home to lower your monthly mortgage payment. However, there won’t be the option to purchase that same home for the price that it is today.

July 2023 Market Update Test

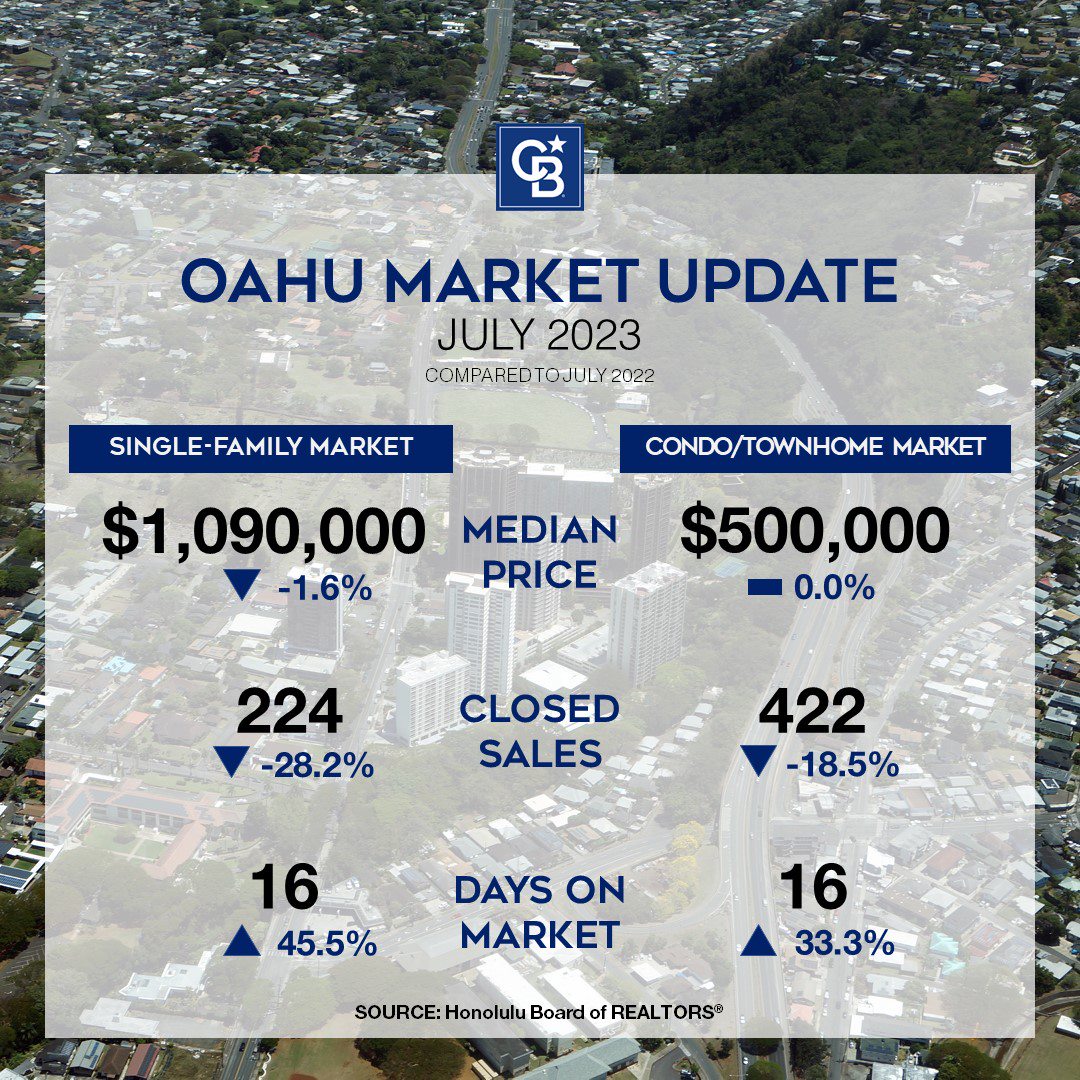

In July 2023, the real estate landscape on Oahu experienced some noteworthy shifts. Let’s dive into the key highlights to keep you updated about the current trends of this dynamic market.

Despite rising interest rates and economic challenges, Oahu’s housing market’s value remains strong. Buyers are resolute in their desire to own property on Oahu whether they are upsizing, downsizing, or building generational wealth.

Median sales prices remain in rock-stable territory year-over-year, with single-family homes dipping slightly — 1.6% to $1,090,000 and condos holding steady at $500,000.

On the upside, 53% of single-family home sales closed at the full asking price or higher. In the condo market, 47% of total sales received the full asking price or higher. These numbers were slightly higher last year.

Overall closed sales on Oahu were fewer last month compared to July 2022. Single-family home sales dropped 28.2% to 224 closings last month compared to a year ago. Condo sales were also down 18.5%.

Interestingly, new listings were also down in both categories at similar rates that sales volume was down. New single-family home listings were down 28.8%. New condo listings were down 15.4%.

What’s new in Kakaako?

If you haven’t been to Kakaako lately, this area between Waikiki and downtown Honolulu is rapidly evolving. Once known for its rich agricultural lands and fish and salt ponds, this area became a mostly industrial hub for local businesses in the mid 1900’s. Today, Kakaako has become a dynamic, urban community where people can live, work, and play. It continues to evolve with each commercial and residential project being completed, developments breaking ground, and new residents moving into the neighborhood.

Koula, Ward Village’s latest tower, officially opened recently with homeowners excited to move into their sleek, luxuriously appointed homes. The resort-style amenities offer a wonderful lifestyle to be enjoyed right outside your home. If you’re interested in a never lived in unit in Koula, please reach out since a few studio, 1- and 2-bedroom units are becoming available.

What are the new projects coming to market in Kakaako?

Kalae is the newest luxury condominium in Ward Village. Slated for completion in 2026, all of the “unrestricted” residences have been reserved as of this writing. This project is a fusion of modern architecture meeting contemporary island living with gorgeous, club-style amenities for residents (and guests) to enjoy Oahu’s beautiful environment.

West of Ward Avenue, two projects will start sales before the end of this year. Situated on Kamehameha Schools land, these condo developments will focus on wellness and lifestyle, offering boutiques, restaurants, and services.

Alia will consist of 486 residential units fronting Ala Moana Boulevard. Developed by the Kobayashi Group whose projects include the Hokua, One Ala Moana, and Park Lane, Alia will offer a variety of amenities including bowling lanes, basketball and pickleball courts, indoor/outdoor gym, karaoke room, dog wash, and movie theater. Completion is planned in 2026.

Kahuina will be a mixed-used project developed by Stanford Carr Development whose projects include Keauhou Place, the Peninsula in Hawaii Kai, and the Cottages at Mauna ‘Olu Estates in Makaha. The project will include 861 residential units, with 60% being designated as workforce and affordable housing.

If you’d like to learn more about any of these new offerings before the official public announcements, please let me know to be updated on floor plans, pricing, model tours, and official launch dates!

Getting our paint on!

I had the pleasure of spending the day with some of my colleagues alongside Honolulu Habitat for Humanity in beautiful Waimanalo recently. We volunteered to help with the finishing touches on a new home on Hawaiian Home Lands for a local family.

Our Coldwell Banker Cares Foundation also donated $1,000 towards this worthwhile cause. The new homeowners have been waiting for more than five years for their home. They were so cute to stop by to thank us in person while we were painting. I’m so excited for them to move it!

ADUs seemed liked a simple solution to Hawaii’s housing crisis

Will home prices drop as interest rates rise?

|

We’ve all seen at least an article or two from national experts forecasting what to expect in home prices in this changing economy. Locally, there is no question that the real estate market is softening due to rising interest rates, high inflation, ongoing supply chain disruptions, and labor shortages. These conditions have weakened housing demand and home price appreciation is slowing down. The graph below provided by local economist, Paul Brewbaker, indicates how single-family home prices have fared over the years, including during recessions reflected by the shaded bars. |

|

|

|

|

Historical data shows that home prices have continued to go up over time as interest rates fluctuate. In the current market, housing is starting to experience a normalizing phase from the COVID buying frenzy that took place over the last two years. Curious to know how much your property value has changed in this market? Give me a call. I would be happy to give you a home valuation or send you a market report of activity in your neighborhood. |

Insider tips to buying a home in today’s market

It is always hard to predict the future, especially with the housing market. But one thing is for sure – real estate remains a sound investment. If you’re looking for your dream home, here are some tips to help set you up for success and guide you through this buying season.

Assess Your Financial Health

Before you fall in love with your dream home, make sure you’re prepared to purchase it. Take a look at your bank accounts along with your monthly spending, so you have a clear and realistic picture of your finances. This will also help you figure out how much you can afford to put toward a down payment. It’s also a good time to check your credit score. Most importantly, you’ll want to meet with a loan officer to get pre-approved, so sellers take you seriously and you’re in a better position to make a strong offer.

Tip: A pre-approval gives you more negotiating power because it tells the seller and real estate agent that your funding is in place and ready to go.

Stay Flexible

Whether it’s time or money, be prepared to give a little more. Say for instance, there’s competition on a house and you’ve been outbid, but you have the flexibility to give the seller the extra time they need to close and move out. That can make a huge difference and could even put you ahead of the competition. Showing the seller that you’re willing to go the extra mile to purchase their home could earn your offer a second glance, especially if it helps make their life easier.

Tip: Try to refrain from asking for favors. This is not the time to ask the seller to give you the refrigerator or washer and dryer, part with playset or paint the front door.

You Found the One

You found a home that meets all or most of your wish list, it’s within your price range and you’ve stalked the neighborhood to make sure it’s right for you. Now’s the time to make an offer. Keep in mind that your opening offer should be based on two things: what you can afford and what you really believe the property is worth. Sure, there’s always a possibility that there will be other offers, regardless of the time of year and the market, but try not to let that influence you to pay more than you should.

Tip: Offer more earnest money. While it’s not always required, it could help you stand out in this competitive housing market. Sellers like buyers that make these good faith deposits because they want assurance that the sale won’t fall through.

Buying a new home is an exciting time and can also be a stressful time, but if you’re prepared and keep these tips in mind, you should find it a much smoother process. And finally getting the keys to your new home makes it all worth it!

Market Update: July 2022

Oahu’s real estate market shows strength despite decline in sales volume

Oahu’s finite amount of available island land on which to build, and historically limited inventory of homes for sale has long been the fundamentals for the island’s relentless housing demand, sustained rise in prices, and a prolonged seller’s market.

But, in July, there was a much-needed inventory relief for frustrated buyers. Active single-family inventory increased 38.8% — from 415 homes for sale in July 2021 to 576 last month. And active condo inventory jumped from 969 listings in July 2021 to 1,050. These higher active-inventory counts hint that a more buyer-friendly market is emerging — a welcome change — for buyers left frustrated by months of slim pickings. [read more including neighborhood standouts]

“Fewer buyers and less competition equal more price reductions and fewer sales — good news for buyers,” says Mike James, president of Coldwell Banker Realty. “And sellers are happy too because while sales volume figures are down from a year ago, when we compare last month’s closed sales volume to pre-pandemic 2019 figures, they are about the same — the market remains strong. Prices are also trending up — Oahu condos set another record month in July.”

But even with some price reductions, and less competition, and more inventory, some buyers are struggling with the effects of higher mortgage interest rates. A year ago, July 2021, 30-year term mortgage rates were below 3% — under 2.5% in some cases. Today, rates are consistently above 5% and moving higher, meaning the same house costs more money each month — causing borrowers to reevaluate what they can afford. The higher rates are literally knocking some buyers out of the game completely.

“So, the market is a bit more buyer-friendly for those who can still qualify for a sufficient mortgage,” adds James. “But some buyers may be forced out of the market — that’s how impactful interest rates can be. And that may also account for last month’s slowing sales volume. When mortgage money gets tight, the qualified-buyer pool shrinks, and sales slow.”

The “big picture” market indicators are positive: Median sales prices are up. Active inventory is trending up. Most sellers are receiving full list price — some higher. Homes are selling very quickly. Median days on the market, while slightly more than a year ago, is still very low.

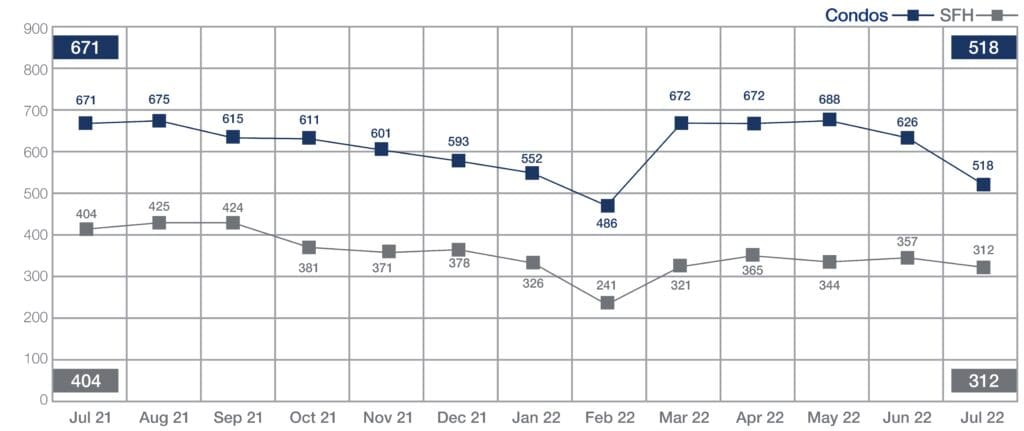

Sales of Single-Family Homes and Condos | July 2022

Source: Honolulu Board of REALTORS®, compiled from MLS data

July housing sales volume dropped 22.8% from July 2021, with fewer closed sales for single-family homes and condos closed. Single-family homes dropped from 404 in July 2021 to 312 last month, and condo sales tumbled from 671 a year ago to 518.

This was the third consecutive month with double-digit declines in sales volume.

Single-family home sales fell across most regions on Oahu, with the largest drop in volume occurring in the Ewa Plain, Kaneohe, and Leeward regions. In the condo market, the Metro region accounted for the largest decline in sales volume.

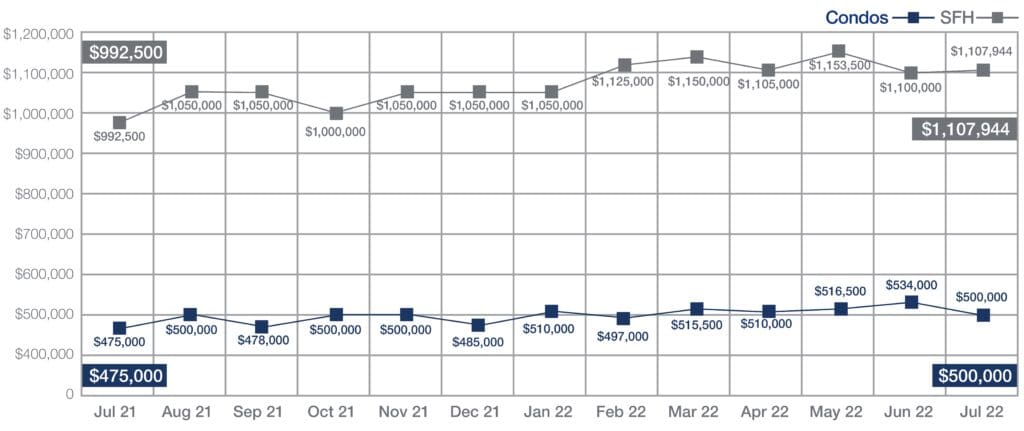

Median Sales Price of Single-Family Homes and Condos | July 2022

Source: Honolulu Board of REALTORS®, compiled from MLS data

The median sales price for a single-family home on Oahu was up for the 12th consecutive month in July — to $1,107,944, from $992,500 a year ago, and 11.6% increase. And the MSP of a condo in July was up 5.3% to $500,000 from $475,000 the previous year. This was the 5th consecutive month the condo MSP came in at $500,000 or higher.

And both year-to-date figures are trending higher than the year-end for 2021. Year-to-date, the SF MSP at the end of July was $1,110,500, compared to $990,000 at the end of 2021. The condo year-to-date figure in July was $515,000, compared to $475,000 in 2021.

NEIGHBORHOOD MARKET STANDOUTS

While overall sales volume on Oahu dropped last month in most neighborhoods, this was not the case island wide. So where were the number of closed sales up? Below are the neighborhoods when, in June, closed sales were higher than 2021.

| SF | Closed sales June 2022 |

Closed sales June 2021 |

% change |

| Mililani | 27 | 17 | 59% |

| Moanalua/Salt Lake | 5 | 4 | 25% |

| North Shore | 13 | 7 | 86% |

| Waipahu | 27 | 20 | 35% |

| Condos | Closed sales June 2022 |

Closed sales June 2021 |

% change |

| Ewa Plain | 62 | 60 | 3% |

| Hawaii Kai | 25 | 20 | 25% |

| Moanalua/Salt Lake | 29 | 23 | 26% |

| Waikiki | 133 | 126 | 6% |

Does the Housing Market Still Favors Sellers?

Ever since interest rates decreased at the beginning of the pandemic, it has been a sellers market in real estate. With low interest rates, buyers took the opportunity to buy homes and secure mortgages at these low rates. Competition for homes has increased significantly along with prices, sales continue to be brisk, and inventory remains low. However, market conditions may be changing in the near future.

Home Buyers

Over the past few months, interest rates have been steadily increasing. While rates averaged around 3% at the end of 2021, they have since increased to an average of 5% at the end of May. Additional increases are planned by the Feds. Despite the sea of potential buyers on the market, the higher interest rates have some of them postponing their home purchase which is allowing the market to move towards some stability.

Home values rose by upwards of 20% over the course of 2021, which means that buying a home today is more expensive than it was just a year ago. Yet, the increased competition for homes has made multiple offers on homes the norm, making it difficult for many buyers’ to have their offer accepted. As demand decreases among buyers, home inventory will begin to increase and purchasing a home may become easier.

In general, housing demand is expected to still be strong and inventory to be relatively low. But, the market won’t be as intense as it was in 2021. Home prices are expected to rise this year but shouldn’t come close to the 20% increase that occurred in 2021.

Home Sellers

If you’re looking to sell your home, the housing market still favors sellers who hold negotiating power. There may not be a lengthy bidding war when you list your home on the market, though. If you want your home to be sold without delay, perform any necessary upgrades and repairs before putting it on the market.

It is unlikely that the housing market will shift completely to favoring buyers. Yet, it’s increasingly likely that the market will become more balanced over the next year or so. A balanced market is great for buyers and sellers alike.

Where will Real Estate’s Wild Ride Go?

One could say that the housing market in 2021 was like a rollercoaster that kept on climbing. On average, home prices rose 10.6% across major cities nationwide in the 3rd quarter of 2021. This marked the fastest rate growth in nearly 17 years. Days on market, mortgage rates, median sales prices and inventory all broke records in 2021.

Why did median home prices rise by 19% for single-family homes on Oahu as well as the rest of the country which experienced similar or even higher double-digit increases? Four key factors: the government stimulus, accrued savings during the lockdowns, a pandemic-induced reassessment of lifestyles, and low interest rates.

With the historically low interest rates, first-time homebuyers flooded the market in search of properties nationwide. However, with the low inventory of homes and the continued shortage of new build homes, competition for properties was fierce and the share of first-time buyers in November was 26% across the U.S. This is the lowest percentage seen since 2014.

Second home buyer demand, on the other hand, is up 83% from pre-pandemic levels in the U.S. This is largely due to the fact that lockdowns and remote work have made vacation destinations more desirable. Many are opting to exchange cramped city life for more space. This demand is expected to continue.

What to Expect In 2022?

Here are my key takeaways from all the data I’ve seen:

* The real estate market will be strong, and more balanced compared to 2021

* The severe inventory shortage and price growth of single-family homes will continue the surge in condo sales

* Mortgage rates will increase

* Median home prices will increase moderately

* Rental prices will continue to rise

If you’d like more details on specific neighborhoods, have been thinking about making real estate moves in 2022 or know someone who may be, let’s chat!

For more details on the housing market:

The Housing Market was on a Wild Ride this Year. Here’s what to expect in 2022 – CNN Business

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link