Rediscovering Manoa Marketplace

Growing up in Manoa, I have fond memories of walking to Manoa Marketplace and getting a mixed Icee at Kay’s Crackseed. My love for sushi began at Kamigata Japanese Restaurant (I’m dating myself 😊). If you haven’t been to Manoa Marketplace recently, you’re in for a nice surprise! The shopping hub has been renewed, featuring a new children’s playground and a cool mix of shops and restaurants.

I recently visited Little Plum, the newest dining spot in the former Bank of Hawaii space. It’s the creation of Dusty Grable’s group (Chinatown’s Lucky Belly and Livestock Tavern). The place was buzzing with conversation and excitement over the local, Asian-inspired cuisine. The menu isn’t extensive—about six teishoku offerings and a similar selection of creative small plates and appetizers. I tried the beef cheek stew. It was my first time trying beef cheek, and I found it a bit tough, but I loved the roasted vegetables that came with it.

If you love cocktails, there’s plenty to choose from: creative craft cocktails, sake, wine, and beer. The ambiance and service were friendly, local, and chill. The service staff wore colorful, kimono-inspired prints, which added to the overall enjoyable experience.

While waiting for your table, hop over next door to its sister retail space, Uncle Paul’s Corner Store. It features an eclectic assortment of items, from kitchen and dining ware to food and seasonings. I bought freeze-dried natto and yuzu mayo for a friend. An interesting feature of the store is the vault from the previous Bank of Hawaii, which will be used as a private wine-tasting room.

It’s worth a visit to check out the new Manoa Marketplace!

Real estate changes coming: What you need to know

The National Association of Realtors (NAR) settlement is bringing changes to the real estate industry, starting August 17, 2024. These changes aim to improve transparency for both buyers and sellers, highlighting the value of professional real estate guidance.

For Sellers:

- Compensation Changes: The way compensation is handled is evolving. Discuss with your trusted agent how this might affect your home sale and explore your options.

- Pricing and Presentation: It’s essential to price your home competitively and showcase its best features to attract the widest pool of buyers.

For Buyers:

- Written Agreements: Before touring homes with an agent, you’ll sign a written agreement outlining services and fees. This ensures you understand the buying process and the associated costs.

- Stay Informed: Keep in close contact with your agent, watch for new listings, and be ready to act quickly on properties that interest you.

Over time, we will see how these changes unfold. Real estate fees, like those in legal, medical, financial, and design professions, will vary based on the level of representation and services provided. What remains constant is my commitment to you: exceeding expectations and protecting your interests.

As always, I’m here to help you navigate these changes and ensure you have a smooth and successful experience. Please reach out with any questions.

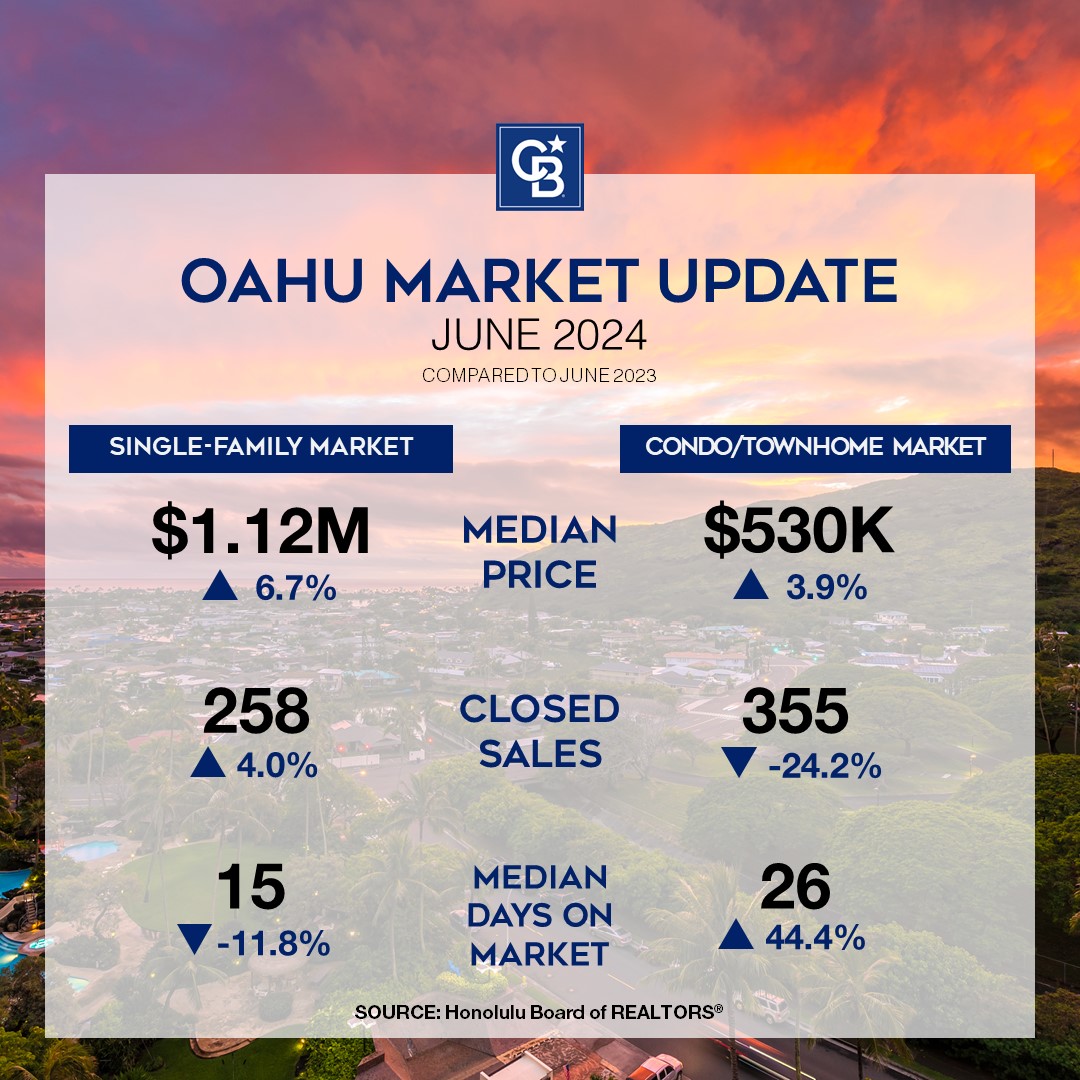

Oahu’s Housing Market: June 30, 2024

The Oahu real estate landscape continues to show consistent trends with low inventory and strong buyer demand for single-family homes. On the other hand, condominium and townhouse sales have slowed due to challenges with insurance premiums and financing for buyers. Let’s explore:

Single-Family Homes:

- Sales increased a modest 4% with 258 transactions closed in June 2024, compared to last year.

- Median sales price: $1,120,000 (up 6.7% from last year).

- Listings spend a median of 15 days on the market.

- Homes that are move-in ready and priced competitively tend to move swiftly under contract and multiple offer situations are not uncommon.

- There were more homes sold in the $1M- $1.6M price range in June 2024 than this time last year, comprising 46% of the single-family homes sold.

Condominiums & Townhouses:

- June 2024 witnessed a 24.5% decline in condo sales, the largest year-over-year decline.

- More than 65% of condominiums currently don’t qualify for conventional financing mostly due to inadequate insurance coverage, deferred maintenance, or litigation.

- Median sales price: $510,000 (up 2% from last year).

- There were 17% more new condo listings than a year ago.

- Active inventory surged to 49% more than a year ago, totaling more than 1,700 units on the market. Specifically, active condo listings priced from $300,000 to $500,000 increased by 104% from a year ago.

The market is ever evolving. If you have questions or need guidance for your specific situation, please feel free to reach out—I’m here to help.

The Power of New Construction

If you’ve ever considered new construction projects or are just curious about why buyers invest in them, please join me for this informational seminar hosted by Kuilei Place.

Build Wealth through Real Estate Seminar: Invest in your future

Wednesday, Jan. 31, 4:00 – 6:00 pm

The Pacific Club

1451 Queen Emma Street

Honolulu, HI 96813

The expert panel will discuss new construction opportunities, leverage strategies, 1031 exchanges, and the power of purchasing real estate with a self-directed IRA.

Featuring:

- Alana Kobayashi Pakkala, EVP/Managing Partner, Kobayashi Group

- Kai Brown, Sales Director, Kuilei Place

- Julie Bratton, VP/Regional Sales Executive, Old Republic Exchange

- Dan Falardeau, President, New Direction Trust Company

Please let me know if you’d like to attend. By RSVP only – seats are limited. Refreshments will be served.

Hawaii’s Housing Market: What to Expect in 2024

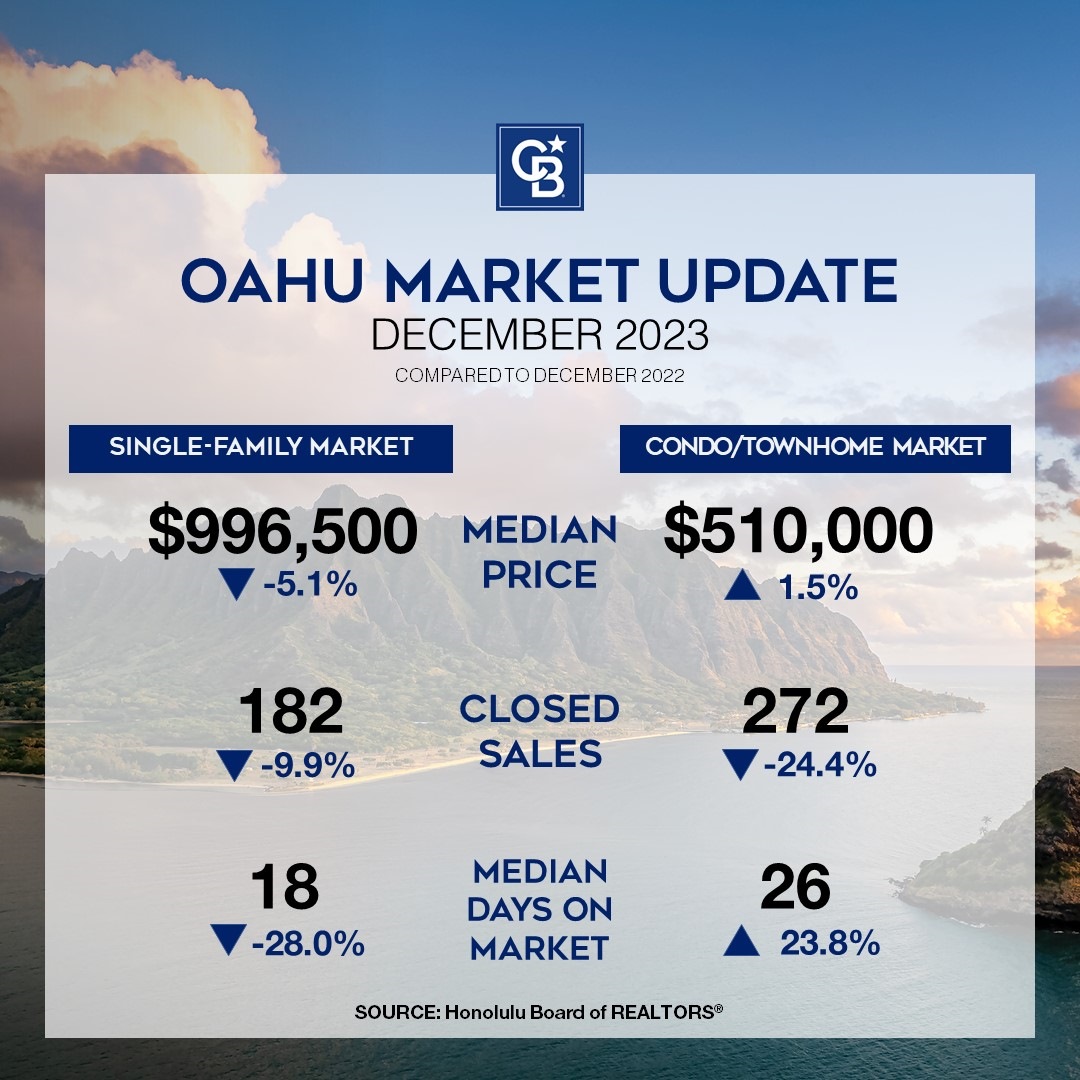

2023 Look Back

The housing market in 2023 marked the slowest year for existing home sales in 30 years, according to the National Association of Realtors (NAR). Challenges included skyrocketing mortgage rates, low inventory of homes, and continued market volatility. Consumer confidence waned, leading buyers and sellers to delay or cancel their buying and selling plans.

On Oahu, the number of single-family homes sales were down 26% from 2022. Condominium unit sales were down 28%. Median prices were pretty much flat from a year ago, decreasing slightly due to low inventory: down 5% for single family homes and 0.3% for condominiums.

Hawaii is experiencing an additional challenge. Soaring hurricane insurance rates are resulting in hundreds of local condominium owner associations unable to cover 100% of replacement costs. It’s estimated that close to 400 condominium associations have renewed policies with less than 100% replacement coverage. The result? Buyers wanting to purchase in these buildings are having difficulty finding lenders willing to approve mortgages due to Fannie Mae and Freddie Mac requirements.

Mortgage Rate Mayhem

If you’re a homeowner with a mortgage, which group do you fall into?

- 78% have mortgages below 5%

- 59% have mortgages below 4%

- 23% have mortgages below 3%

Nearly 9 in 10 U.S. homeowners have a mortgage rate below 6%, according to Redfin. With the average mortgage rate over 6% currently, most homeowners are delaying selling and opting to stay put to avoid paying a higher rate for their replacement property. Consequently, it is this “lock-in” effect that has caused the inventory shortage of homes.

Most economists agree that the Fed is done with raising its policy rate. It has signaled three rate cuts this year. NAR Economist Lawrence Yun forecasts that home sales nationally will rise 13.5% from 2023 levels and prices will increase by 0.9%. Yun sees mortgage rates averaging 6.3% in 2024.

Greener Pastures in 2024?

There will always be sellers who must sell their property and buyers needing to buy a home due to life circumstances. We are seeing increases in new listings in January. This is typical of the season. Sellers (and buyers) are also coming to terms with the fact that interest rates aren’t going back down to 3% any time soon.

When interest rates do decrease, buyers will likely flood the market due to pent up demand. Bidding up and multiple offer situations will occur just as it did when rates went to 3% and lower. Also, seller concessions won’t be as available with increased demand from buyers. If you are looking to buy a property and are financially ready, now may be the best time to search for that property that checks most or all your boxes. And, being ready to make an offer.

The Big Benefits of Downsizing Your Home

If you’re considering downsizing, you’re not alone. Many homeowners are embracing the advantages of living in smaller spaces. Living smaller can offer a range of benefits, from cost savings to a better quality of life. Let’s explore the advantages of downsizing and why it’s becoming an increasingly popular option.

Financial Considerations

One of the main advantages of downsizing is the positive impact it can have on your wallet and finances. By moving to a smaller home, you can enjoy lower mortgage payments, reduced property taxes and decreased utility bills. These savings can free up a significant amount of money, giving you the opportunity to pay off debts, travel, invest or save for the future – tiny houses are fashionable for a reason!

Simplified Lifestyle & Maintenance

Even if you don’t go all the way down to tiny, another great perk of a reduced space is the simplified lifestyle it offers. With fewer rooms to clean, maintain and organize, you can spend less time on household chores and decluttering, and have more time to do the things you love with friends and family. Imagine how a more manageable home could help you find balance and fulfillment in your daily life. There are also great tips available for decorating a scaled-down home so you can still make it stylish and inviting.

Increased Flexibility

Downsizing can also provide you with more agility and mobility, which is ideal for avid travelers and explorers. A week or even a month away doesn’t seem as daunting with a smaller property. Since it requires less upkeep, it can allow you to spend extended periods away without worry. Additionally, it can create a more adaptable living environment for retirees or empty nesters, making it easier to adjust to changing circumstances throughout your life.

Environmental Perks

Going smaller not only benefits you personally but also has positive environmental impacts. A more minimal living space conserves resources like energy and water, reducing your carbon footprint. With fewer rooms to heat and cool, you’ll see lower energy emissions and monthly bills. Plus, downsizing encourages a more intentional and mindful approach to consumption, promoting a greener and eco-friendly lifestyle, if that’s your thing.

The benefits go beyond simply living in a reduced space. Downsizing allows you to create a home that aligns with your values, offering greater freedom and contentment. So, if you’ve been considering downsizing or rightsizing in the future, take the leap and embrace the many advantages that await. Say goodbye to excess and hello to a simpler, more fulfilling lifestyle.

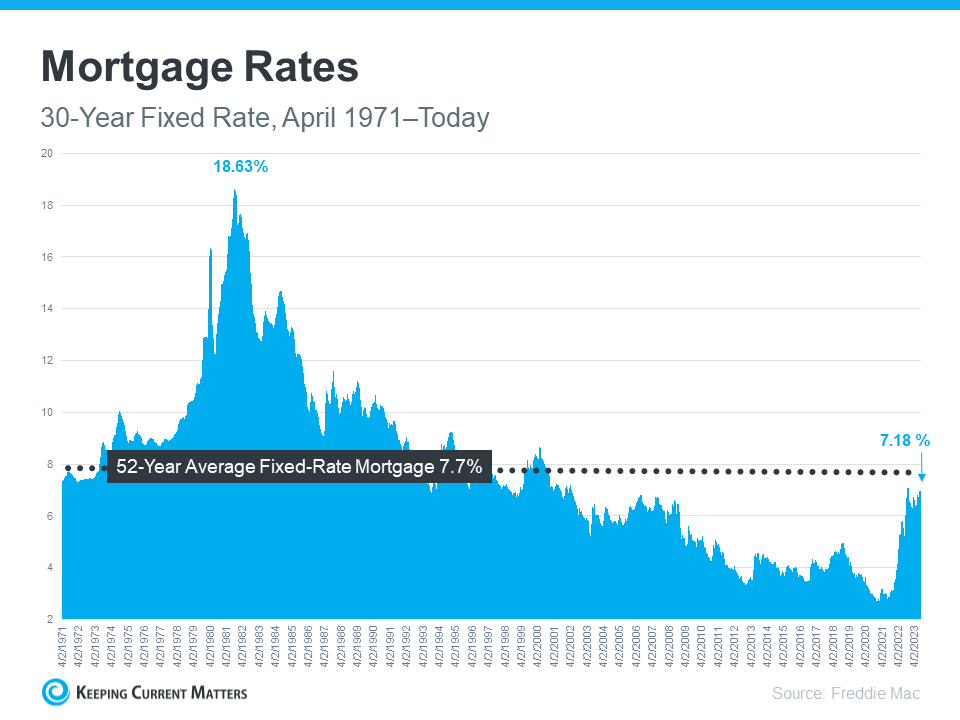

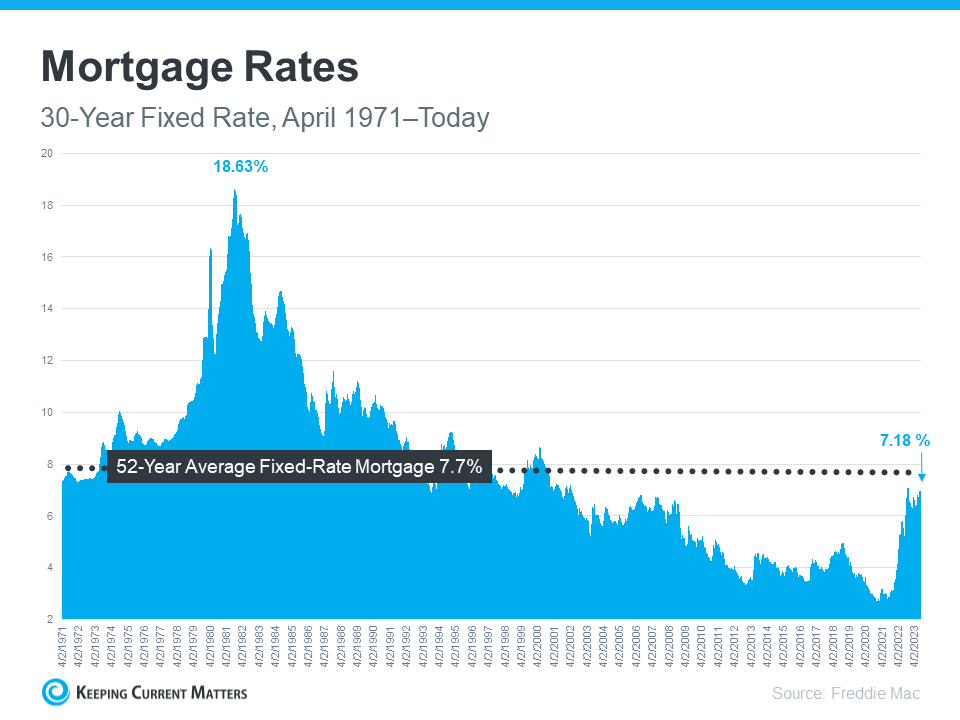

Mortgage Rates: Past, present, and possible future

If you’re hoping to buy a home this year, you’re probably paying close attention to mortgage rates. Since mortgage rates impact what you can afford when you take out a home loan – and affordability is a challenge today – it’s a good time to look at the big picture of where mortgage rates have been historically compared to where they are now. Beyond that, it’s important to understand their relationship with inflation for insights into where mortgage rates might go in the near future.

Giving Context to the Sticker Shock

Freddie Mac has been tracking the 30-year fixed mortgage rate since April of 1971. Every week, they release the results of their Primary Mortgage Market Survey, which averages mortgage application data from lenders across the country (see graph below):

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

That’s important because it explains why the recent jump in rates might have you feeling sticker shock even though they’re close to their long-term average. While many buyers have adjusted to the elevated rates over the past year, a slightly lower rate would be a welcome sight. To determine if that’s a realistic possibility, it’s important to look at inflation.

Where Could Mortgage Rates Go in the Future?

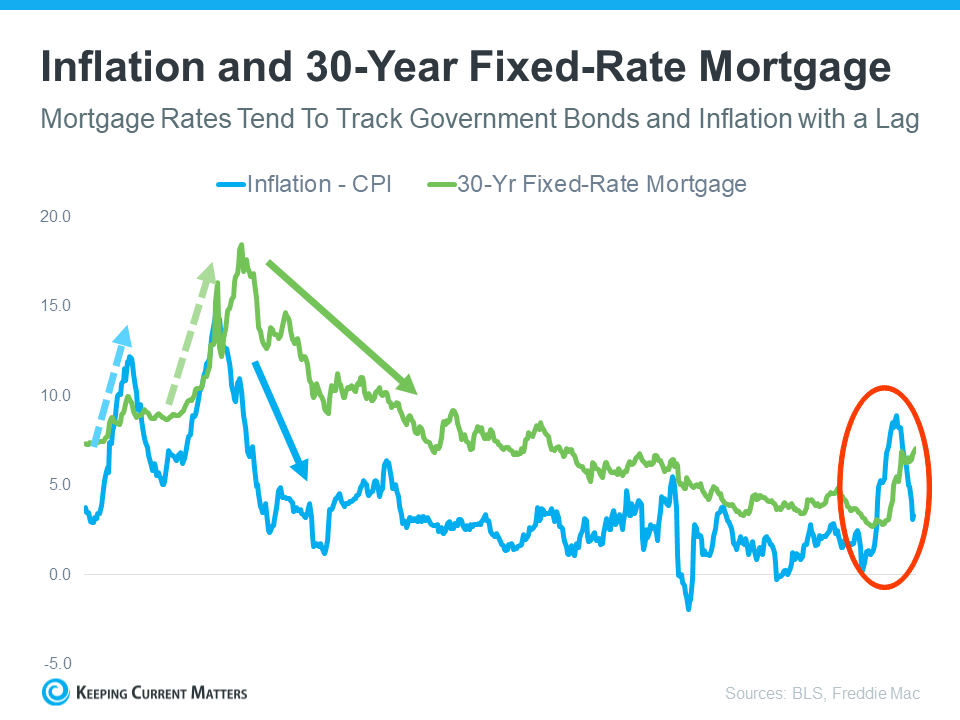

The Federal Reserve has been working hard to lower inflation since early 2022. That’s significant because, historically, there’s been a connection between inflation and mortgage rates (see graph below):

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

The circled portion of the graph points out the most recent spike in inflation, with mortgage rates following closely behind. As inflation has moderated a bit this year, mortgage rates haven’t yet made a similar move.

That means, if history is any guide, the market is waiting for mortgage rates to follow inflation and head back down. It’s impossible to accurately predict where mortgage rates will go for sure, but moderating inflation means mortgage rates going down in the near future would fit a well-established trend.

Bottom Line

To understand where mortgage rates may be going, it’s helpful to look at where they’ve been in the past. There’s a clear connection between inflation and mortgage rates, and if that historical relationship holds true, the recent decline in inflation may mean good news for the future of mortgage rates and your homeownership goals.

Source: Keeping Current Matters

Aloha Aina Award Nominee

Lori Hiroe Makiya is an Aloha Aina Award Nominee for 2023 once again. She was nominated by multiple clients who took the time to write about their experience working with Lori.

“I am truly grateful and humbled to be an Aloha Aina Award Nominee this year. This recognition means so much to me because it comes from my wonderful clients.” She added, “Thank you for your trust and for allowing me to help you with one of the most impactful events in your life. It is a privilege and pleasure serving you.”

The Aloha Aina Realtor Awards Program honors and publicly recognizes Realtors who excel in the real estate profession and provide exceptional service to their clients. The winners have gone above and beyond in service to their clients, and who maintain the highest ethical standards.

Irresistable pumpkin recipes for a flavorful Fall

As temperatures drop, the kitchen spotlight turns to a humble and versatile ingredient – the pumpkin. Delve into the delicious world of pumpkin-infused dishes that celebrate both flavor and creativity with comforting classics and innovative creations. Most of these pumpkin recipes call for canned pumpkin, but if you feel like making your own puree, look for sugar or pie pumpkins at the store – leave the large jack-o’-lantern types for carving.

One Bowl Chocolate Chip Pumpkin Muffins

Pumpkin and chocolate are a perfect match, as demonstrated in this take on muffins from The Kitchn blog. Warm pumpkin pie spices combine with semi-sweet chocolate chips for the perfect afternoon snack or brunch side. Take care not to overmix the batter before pouring it into the muffin cups – this, along with the pumpkin puree, helps keep the muffins moist. Plus, the scent as these beauties bake will make your home smell better than a pumpkin spice latte.

Pumpkin Lasagna with Ricotta and Swiss Chard

When you crave something baked and cheesy, look no further than Food & Wine magazine’s unique take on a classic comfort dish. Instead of the traditional tomato sauce, a pumpkin cream sauce ties everything together and complements the tender swiss chard and creamy ricotta cheese layers. Want to plan ahead? This lasagna can also be made ahead of time and stored overnight in the refrigerator. It’s meat-free, too, making it a great company dish for vegetarian friends and family.

Pumpkin Pancakes

Start your morning with a taste of autumn’s finest – a fluffy stack of flavorful pancakes. This breakfast favorite from King Arthur Baking Company combines the seasonal flavors of cinnamon and nutmeg and the ease of canned pumpkin puree. They are fantastic with maple syrup or whipped cream, or why not both? Whether you’re enjoying a leisurely weekend brunch or seeking a quick weekday treat, these pancakes are a delicious invitation to savor the comforts of the season.

Pumpkin Soup with Bacon and Thyme

This savory soup, also from Food & Wine, calls for roasting and pureeing a fresh three-pound pumpkin, but you could also substitute the same amount of butternut or acorn squash to mix things up a bit. While prepping your pumpkin or squash, save the seeds, and roast them for a delightfully crunchy topping. The garlic, thyme, cinnamon, nutmeg and cayenne pepper add just the right touch of herb, heat and pumpkin spice warmth to this earthy and smoky pumpkin soup.

Best, Easy Pumpkin Pie Recipe

What fall pumpkin recipe list would be complete without a pumpkin pie? This classic recipe from Country Living magazine promises big rewards from a manageable culinary effort. Use either store-bought or homemade pie dough and canned pumpkin. While fresh pumpkin is fantastic in some recipes, it can sometimes be stringy after roasted, which is not ideal when your goal is a velvety pumpkin pie filling. So, for this recipe, it’s recommended to stick to the canned puree. The burnt sugar brulée topping is a true showstopper and well worth the investment in a small kitchen torch. But even if you leave that detail off, this is still a pumpkin pie you’ll make year after year for your holiday table.

Whether you’re already a pumpkin fan or merely pumpkin-curious, these recipes give you a solid start to filling your home with fall’s comforting spices and flavors.

Homeowner alert: Property insurers rethink coverage in Hawaii

If you are a property owner, there’s a good chance that your insurance premiums have increased, or will increase, perhaps significantly. After several unprecedented natural disasters on the mainland, states like Texas, Florida, and California have seen insurance carriers massively raise rates or leave these markets entirely.

Now Hawaii has come into the spotlight with the tremendous losses from the recent Maui wildfires. With the increase in natural disasters, insurers and banks are scrutinizing home insurance policy coverage. They are finding that insurance coverage limits, specifically for some condominiums, may not be sufficient to cover the full expense of claims.

The result? Allstate just placed a moratorium on all new condominium (HO6) homeowner insurance policies throughout Hawaii effective September 25, 2023. Additionally, local banks are not approving new home loans for a growing list of condominiums that are “underinsured.” Please reach out to me or your insurance agent if there’s a specific condo you are concerned about.

Read more about this property insurance storm that has been brewing with the increasing effects of climate change. [more]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link