2023 Look Back

The housing market in 2023 marked the slowest year for existing home sales in 30 years, according to the National Association of Realtors (NAR). Challenges included skyrocketing mortgage rates, low inventory of homes, and continued market volatility. Consumer confidence waned, leading buyers and sellers to delay or cancel their buying and selling plans.

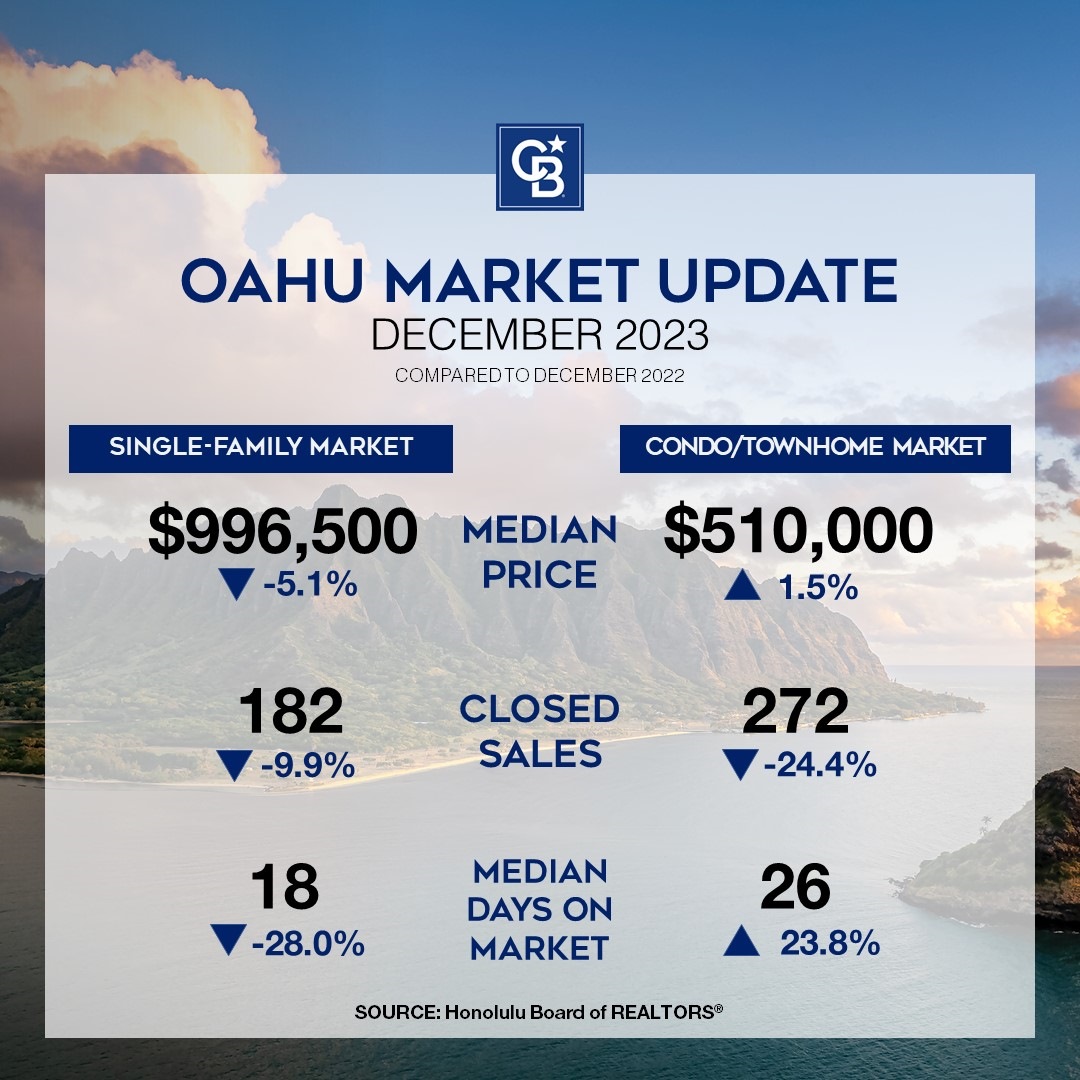

On Oahu, the number of single-family homes sales were down 26% from 2022. Condominium unit sales were down 28%. Median prices were pretty much flat from a year ago, decreasing slightly due to low inventory: down 5% for single family homes and 0.3% for condominiums.

Hawaii is experiencing an additional challenge. Soaring hurricane insurance rates are resulting in hundreds of local condominium owner associations unable to cover 100% of replacement costs. It’s estimated that close to 400 condominium associations have renewed policies with less than 100% replacement coverage. The result? Buyers wanting to purchase in these buildings are having difficulty finding lenders willing to approve mortgages due to Fannie Mae and Freddie Mac requirements.

Mortgage Rate Mayhem

If you’re a homeowner with a mortgage, which group do you fall into?

- 78% have mortgages below 5%

- 59% have mortgages below 4%

- 23% have mortgages below 3%

Nearly 9 in 10 U.S. homeowners have a mortgage rate below 6%, according to Redfin. With the average mortgage rate over 6% currently, most homeowners are delaying selling and opting to stay put to avoid paying a higher rate for their replacement property. Consequently, it is this “lock-in” effect that has caused the inventory shortage of homes.

Most economists agree that the Fed is done with raising its policy rate. It has signaled three rate cuts this year. NAR Economist Lawrence Yun forecasts that home sales nationally will rise 13.5% from 2023 levels and prices will increase by 0.9%. Yun sees mortgage rates averaging 6.3% in 2024.

Greener Pastures in 2024?

There will always be sellers who must sell their property and buyers needing to buy a home due to life circumstances. We are seeing increases in new listings in January. This is typical of the season. Sellers (and buyers) are also coming to terms with the fact that interest rates aren’t going back down to 3% any time soon.

When interest rates do decrease, buyers will likely flood the market due to pent up demand. Bidding up and multiple offer situations will occur just as it did when rates went to 3% and lower. Also, seller concessions won’t be as available with increased demand from buyers. If you are looking to buy a property and are financially ready, now may be the best time to search for that property that checks most or all your boxes. And, being ready to make an offer.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link